49+ can you deduct rental property mortgage payments

Web As a rule of thumb a rental property owner can deduct interest payments made to acquire or improve a rental property. Compare More Than Just Rates.

Rental Property Calculator Most Accurate Forecast

Ad Dont Take Chances w the Law.

. Stamp duty land tax SDLT. Web If you are married and filing separately from your spouse you can deduct interest payments on mortgage debt up to 375000 each tax year For mortgages taken. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator.

Web Answer In general you can deduct mortgage insurance premiums in the year paid. When you buy a property you need to pay SDLT on the purchase price. Web How to deduct mortgage interest on federal tax returns When you file taxes you can take the standard deduction or the itemized deduction.

Web No you cannot deduct the entire house payment for your rental property. Get Access to the Largest Online Library of Legal Forms for Any State. You cannot deduct principal mortgage payments from your income whether your real estate property is your primary residence or a rental.

Common tax-deductible interest expenses. Web Taxpayers must recover the cost of rental property through an income tax deduction called depreciation. Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately.

Web Web Web A mortgage refinance calculator can help you see how a new home loan would affect you. However you can deduct the mortgage interest and real estate taxes that you paid for. Web As a rental property owner there are several expenses that you can deduct from your taxes to save you money and improve your overall operation.

Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property. Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Web The short answer is no. Landlords are granted many tax advantages as owners of investment real. Web The interest you pay is income to the lender however on which the lender must pay income tax -- because the lender pays the income tax on this portion you can deduct it.

The rate of SDLT varies depending on the value of. Web Although rental property can of course generate large revenue streams for property owners it is quite important that you continue to plan and save for mortgage. This annual allowance accounts for a propertys wear.

Find A Lender That Offers Great Service. Get an Expert Opinion2nd Opinion. However if you prepay the premiums for more than one year in advance for.

Can I Write Off Mortgage Payments On Rental Properties Solve Report

Ws Jan 24 2014 By Weekly Sentinel Issuu

Sgd Inr 50 With Sg 50 Aditya Ladia

Is Your Mortgage Considered An Expense For Rental Property

Solved Consider The Buy Vs Rent Excel Spreadsheet Chegg Com

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

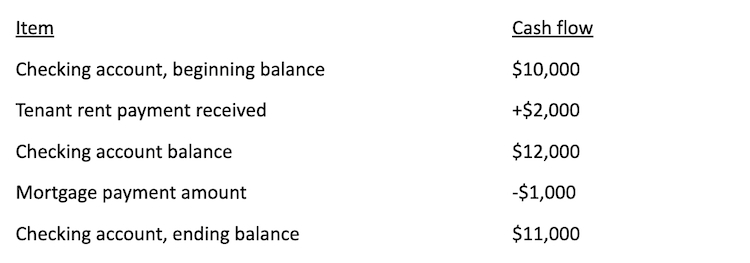

Can You Write Off The Difference Between The Rent Collected Mortgage Paid

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

Top Tax Deductions For Second Home Owners

Business Succession Planning And Exit Strategies For The Closely Held

Vacation Home Rentals And The Tcja Journal Of Accountancy

Can I Deduct Mortgage Insurance Premiums From Rental Property Sapling

Is Your Mortgage Considered An Expense For Rental Property

424h

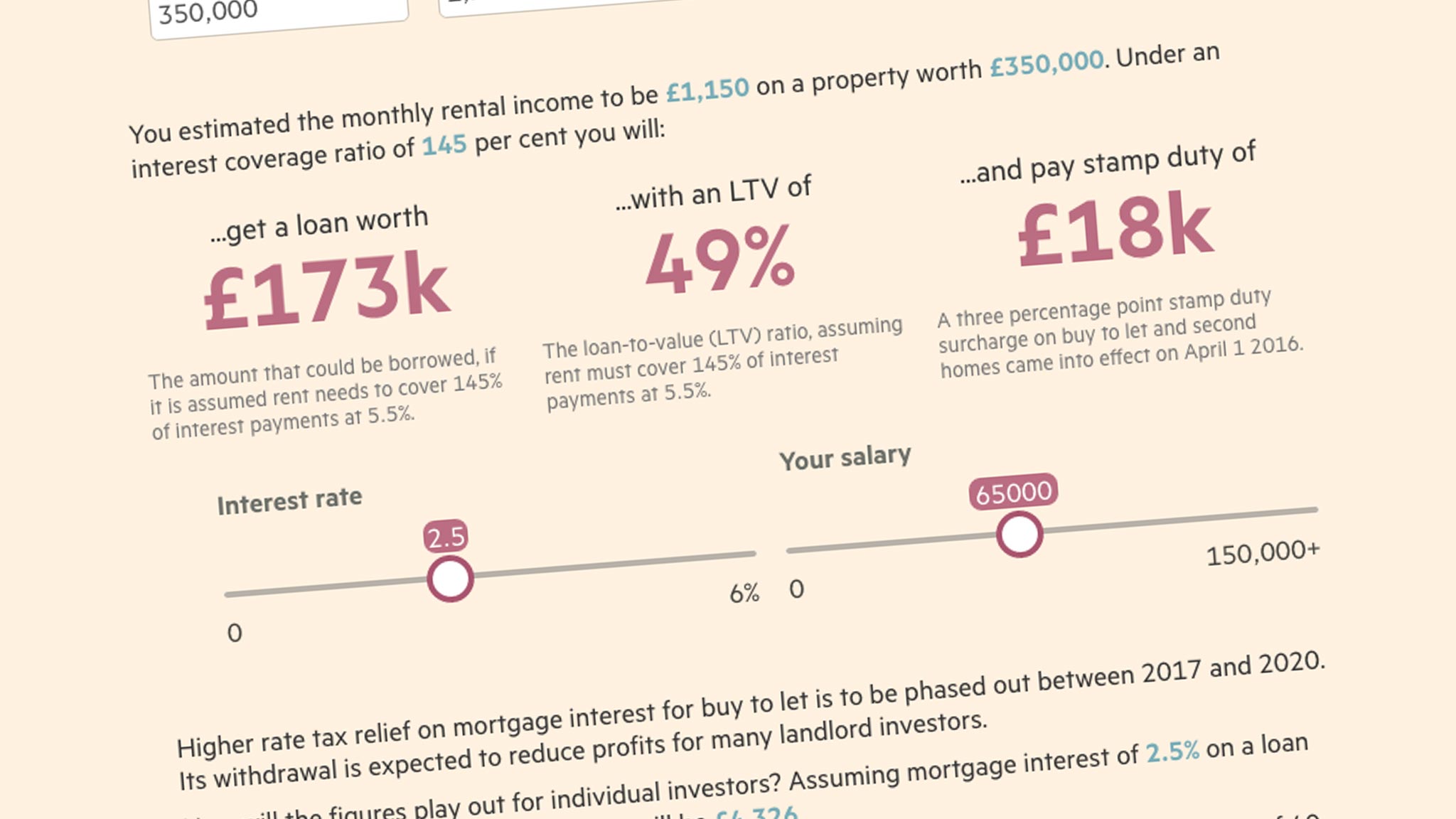

Is Your Buy To Let Investment Worth It Use This Calculator To See If Your Sums Add Up

424h